Table of Content

Eligibility Find out if you're eligible for a VA direct or VA-backed home loan, based on your service history and duty status. The purpose of the database is to connect women veterans to information, resources, and events that can help them. If you qualify and would like to be interred at one of Kentucky's state veterans cemeteries, you can fill out the pre-application form. To be eligible, you must own a non-commercial motor vehicle that is registered in Kentucky.

First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. If you choose to get prequalified, you'll provide documentation that outlines your financial situation, such as bank statements, pay stubs and credit reports. This information is then reviewed by your lender, who is able to determine if you're an acceptable candidate for a loan, and if so, what kind of mortgage rate will be offered.

Louisville Kentucky VA Home Loan Mortgage Lender: Louisville Kentucky Mortgage Lender VA Home Loans

As of Jan 1, 2022, VA loan limits for all counties in Kentucky are $647,200.

You can obtain a VA loan for a manufactured or modular home with Guaranteed Rate in all states, single-wide manufactured homes and leasehold properties not included. Like all VA loans, you need a Certificate of Eligibility and proof of service. Your spouse was rated disabled and was eligible for disability compensation at the time of death. Borrowers will still need to be approved by a qualified lender under VA loan conditions in order to secure this type of mortgage. In the past twelve months, home appreciation has been 0.50 percent.

Find a VA lender today

He even worked with us throughout the weekend, which shocked me. THANK YOU SO MUCH FOR WORKING WITH US THROUGHOUT THE ENTIRE PROCESS. Check out our Loan Application Checklist to see if you are ready to apply.

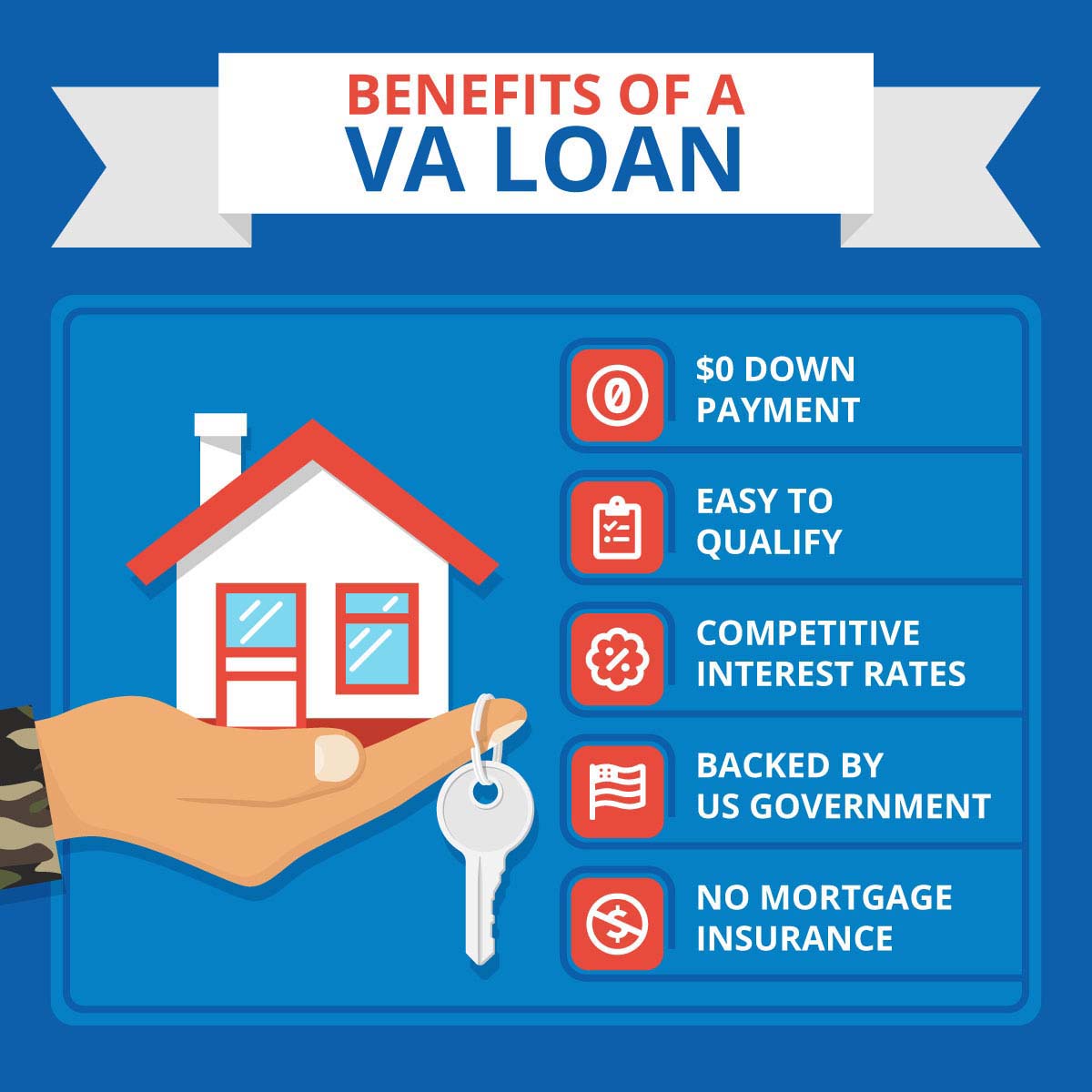

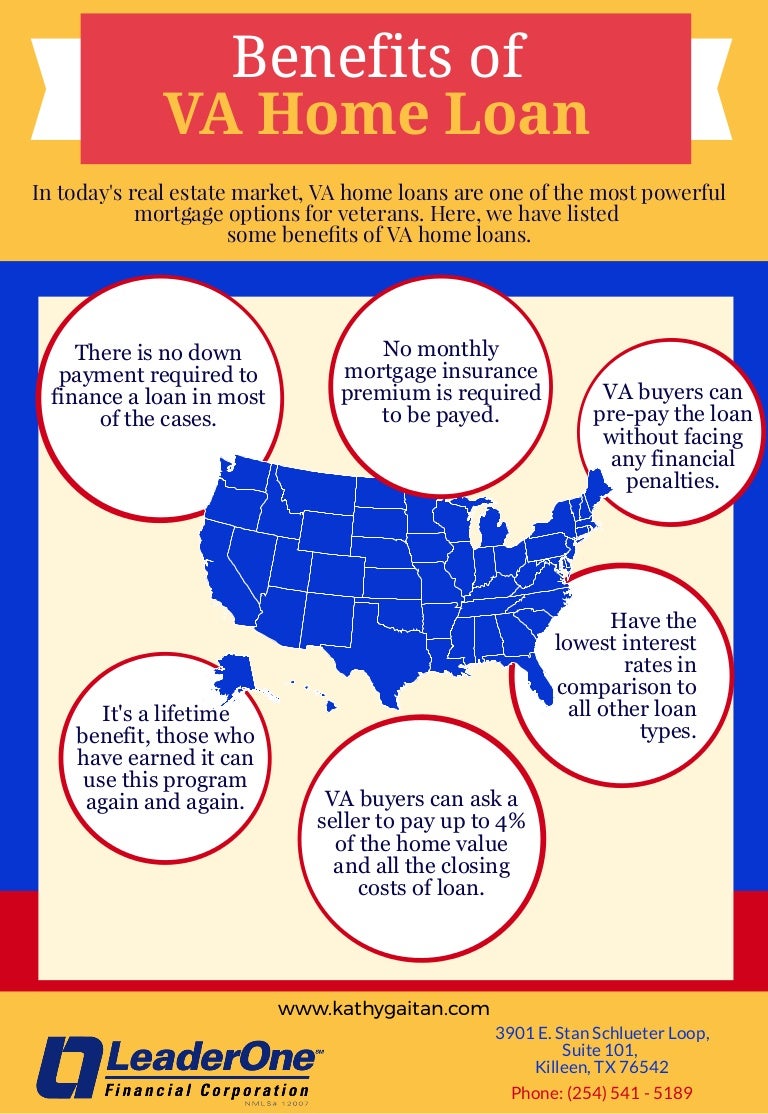

Find out if you're eligible for a VA-backed IRRRL to help reduce your monthly payments or make them more stable. No down payment, no mortgage insurance These are perhaps the biggest advantages... Call Us Today To Get the Most Competitive Rate On Your Home Mortgage Refinance. To pick the best offer, compare the Loan Estimate document each lender provides after you apply. The Loan Estimate will tell you how much cash you’ll need for closing costs. When you refinance to borrow more than you owe on your current loan, the lender gives you a check for the difference.

Metro Mortgage Lending, Inc

I had some credit issues that required a little extra work but Joel was able to find A VA lender to approve my situation as far as having past bad credit problems and a lower credit score. We closed yesterday on our home here in Louisville and we could not be happier. Great experience and closed 8 days before expected close date so we were able to move in early. We just moved here the first of January in 2017 from Ohio to the Louisville, KY area and we found Joel's website online.

VA Home Loan Centers is an approved originator of VA mortgages. Fort Knox is one of the largest U.S. military bases and is operated by both theMarinesand the U.S. In 2010, the Army Human Resource Center of Excellence opened in Kentucky and it employee’s number almost 4,300 people, including soldiers and civilians. View the graphic below to learn more about how VA loans work in Kentucky.

VA mortgages

We finally have a home of our own thanks to Joel .I would definitely recommend him for a mortgage loan. He was very knowledgeable about the local market and kept us up-to date throughout the loan process and was a pleasure to meet at closing. Kentucky boasts a veteran population of more than 342,000, making it a great place for veterans, and current service members to reside.

These letters provide documented proof of the applicant's history of service and whether they are entitled to a VA loan. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. No down payment required for Kentucky VA Loans There are closing costs on all home purchases and refinances, however, on purchases, V...

If you're a veteran or current servicemember living in the Bluegrass State, you might qualify for a lot of the benefits discussed below. Your state and your country want to honor you for your service. They can help you afford a home, go back to school, get a job, and more. Kentucky FHA Mortgage Credit Score Requirements FHA is introducing new guidelines on loan to value ratios and the minimum credit score requ... $10,000 available thru KHC for down payment assistance KY What is Kentucky Housing?

You and the lender will try to close the loan before the rate lock expires. Bank of England Mortgage is an equal opportunity employer and encourages women, minorities, persons with disabilities, and veterans to apply. Disability compensation Find out how to file a claim for compensation for conditions related to your military service. Apply for a Specially Adapted Housing grant Get financial help to make changes to your home to help you live more independently with a service-connected disability. Find VA-acquired properties Learn more about buying a home we've acquired because its VA direct or VA-backed home loan was terminated. Home buying process for Veterans Get more information about using your VA home loan benefit to buy a home.

While these loans generally follow the same processing steps nationwide, the VA does set specific requirements for some areas. Standards around energy efficiency, insect inspectionos and environmental hazards can all vary from state to state and borrowers are obligated to meet these standards for an approved loan. With a VA-backed home loan, we guarantee a portion of the loan you get from a private lender.

Estimated monthly payment and APR assumes that the VA funding fee of $6,072 is financed into the loan amount. Estimated monthly payment does not include amounts for taxes and insurance premiums, and the actual payment obligation will be greater. First-time home buyer assistance programs in Kentucky and across the U.S. offer loans, grants, down payment assistance and tax credits. But availability and qualification requirements can vary.

Want to take cash out of your home equity to pay off debt, pay for school, or take care of other needs? Find out if you're eligible for a VA-backed cash-out refinance loan. Find out if you're eligible for a VA-backed purchase loan to get better terms than with a private-lender loan. Lenders follow our VA standards when making VA-backed home loans.

This is just a small sampling of one program in each area. The full list can be viewed online, along with contact information for all programs. Get a VA home loan quote from the Nation's most trusted lenders. Your journey to owning a decent home as a veteran begins with contacting VA Loans Center. We are committed to ensuring that veterans reside in decent homes.

No comments:

Post a Comment